A Car Loan Calculator is a valuable financial tool designed to help car buyers estimate their monthly payments, total interest, and the overall cost of purchasing a vehicle through financing. Whether you’re buying a new car, a used one, or refinancing an existing loan, understanding your financial commitment is crucial before stepping into a dealership.

Auto loans often include multiple cost components such as taxes, fees, insurance, and interest. Without a clear picture of these, buyers risk overextending their budget. This calculator provides clarity by offering detailed breakdowns and smart financial projections, making it easier to make informed decisions.

This tool is ideal for:

-

Individuals planning to finance a car purchase

-

Buyers comparing loan offers from banks or dealerships

-

Budget-conscious families planning vehicle ownership

-

Financial advisors guiding clients through auto financing

Key Features

1. Comprehensive Loan Inputs

The calculator provides full customization for realistic and flexible planning:

-

Vehicle Price: Enter the full value of the car (supports any currency symbol).

-

Down Payment: Specify either a fixed amount or a percentage of the vehicle price.

-

Loan Term: Choose the repayment period in either months or years.

-

Annual Interest Rate (APR): Input the rate offered by the lender.

-

Additional Costs: Include estimated sales tax, registration fees, dealer charges, or insurance.

-

Trade-in Value: Subtract the value of your old vehicle from the total cost (optional).

2. Advanced Calculations

The calculator goes beyond monthly payments by providing deep insights:

-

Monthly Payment: Automatically calculates what you’ll owe each month.

-

Total Interest Paid: Shows how much you’ll pay in interest over the life of the loan.

-

Total Vehicle Cost: Displays the full cost, including down payment, interest, and fees.

-

Loan-to-Value (LTV) Ratio: Helps determine how much of the car’s price is being financed.

-

Monthly Payment as a Percentage of Income: Assesses affordability based on your income.

3. Visual Analysis Tools

Understand your financing at a glance:

-

Pie Chart: Displays a breakdown of principal vs interest and other costs.

-

Amortization Schedule: Month-by-month view of how your loan is paid off.

-

Interest vs Principal Chart: Visual timeline of loan balance reduction.

-

Comparison Tables: Quickly compare loan options side by side.

4. Smart Features

Make smarter financial decisions with intelligent built-in tools:

-

Scenario Comparison: Compare different loan amounts, rates, and terms.

-

Early Payoff Insights: See how extra payments can reduce total interest.

-

Payment Frequency Options: Choose monthly or bi-weekly payment schedules.

-

Financial Health Indicators: Ensure loan fits your income and budget.

-

Budgeting Advice: Suggestions for down payments and term selection based on financial goals.

5. Results Display

Every result is presented in a clear and professional layout:

-

Detailed Monthly Breakdown

-

Interactive Amortization Schedule

-

Full Cost Summary

-

Visual Graphs and Charts

-

Helpful Financial Recommendations

6. Visual and User Interface

Designed to be intuitive and visually appealing:

-

Automotive-inspired design with a modern look

-

Color-coded charts for easy interpretation

-

Multiple professional theme options:

-

Professional Blue

-

Financial Green

-

Business Purple

-

Automotive Indigo

-

Classic Red

-

Dark Gray

-

-

Responsive Design: Works flawlessly on desktops, tablets, and smartphones

-

Dark Mode: Available for better night-time or low-light usage

How to Use the Car Loan Calculator

-

Enter Vehicle Price

-

Add Down Payment Amount (or select percentage)

-

Choose Loan Term in months or years

-

Enter APR (Interest Rate)

-

Input Additional Fees like taxes and insurance

-

Include Trade-In Value if you have one

-

Click “Calculate” to receive a full breakdown of your loan details

Benefits of Using a Car Loan Calculator

-

Compare multiple auto loan offers with ease

-

Understand the true cost of car ownership

-

Plan your monthly budget with confidence

-

Avoid financial surprises with detailed cost analysis

-

Negotiate better terms by knowing your numbers

-

Decide on the optimal down payment to reduce interest

Technical Details

-

Based on standard auto loan amortization formulas

-

Accurate to two decimal places for financial clarity

-

Supports various currencies, interest types, and term lengths

-

Real-time updates as you input or change values

-

Optimized for use on mobile, tablet, and desktop devices

Common Use Cases

-

Financing a new or used vehicle

-

Exploring auto loan refinancing options

-

Comparing dealership vs bank financing

-

Evaluating lease vs buy decisions

-

Planning for a future car purchase within budget

-

Reviewing payment options before visiting a dealer

Key Mathematical Formulas

-

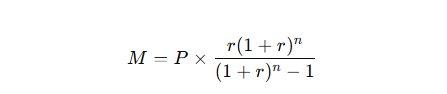

Monthly Payment:

Where:

M = monthly payment,

P = loan principal,

r = monthly interest rate (APR ÷ 12 ÷ 100),

n = total number of payments -

Total Interest Paid:

-

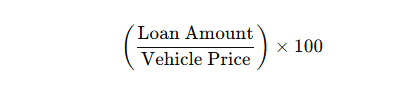

Loan-to-Value (LTV) Ratio:

(Loan AmountVehicle Price)×100\left(\frac{\text{Loan Amount}}{\text{Vehicle Price}}\right) \times 100

Financial Tips for Smart Auto Financing

-

Shop for the lowest APR: Your credit score greatly impacts the interest rate. Improve it before applying.

-

Make a larger down payment: Reduces your monthly burden and total interest.

-

Shorter loan terms mean less interest: But ensure the monthly payment fits your budget.

-

Understand the difference between APR and interest rate: APR includes fees and is a better reflection of loan cost.

-

Use bi-weekly payments: Can help reduce total interest and pay off the loan faster.

Conclusion

A Car Loan Calculator is more than just a math tool—it’s a decision-making companion that brings clarity to one of the most significant purchases many people make. By providing accurate monthly payments, interest projections, and cost breakdowns, this tool empowers you to make smart, informed, and confident choices when financing your next vehicle.

Whether you’re buying your first car, upgrading your current ride, or refinancing to get a better rate, the Car Loan Calculator helps you understand your finances from every angle—before you sign any paperwork.

No Comments