A House Affordability Calculator is a powerful financial tool designed to help prospective homebuyers estimate how much home they can realistically afford. By inputting key financial information such as income, debts, and expected housing costs, users can determine a budget that aligns with both their financial situation and lender guidelines.

Before beginning your home search, it’s crucial to understand your home buying budget. Overextending financially can lead to mortgage denial or future financial hardship. One of the key factors in mortgage approval is the Debt-to-Income (DTI) ratio, which lenders use to assess whether you can manage monthly payments.

Whether you’re a first-time homebuyer, planning to upgrade your home, or exploring investment properties, this tool provides valuable insights to support smart decision-making.

Key Features

1. Comprehensive Financial Input

The calculator accepts a wide range of financial inputs for personalized results:

-

Annual Household Income (Pre-Tax) – Total income for all buyers

-

Mortgage Loan Term – Typically 15, 20, or 30 years

-

Interest Rate – Reflects current mortgage market trends

-

Monthly Debt Payments – Including car loans, credit cards, student loans

-

Down Payment – Percentage (e.g., 20%) or fixed dollar amount

-

Property Tax – As a percentage of home value or specific amount

-

HOA or Co-op Fees – Monthly association dues

-

Homeowner’s Insurance – Estimated monthly or annual cost

-

Debt-to-Income Ratio Options – Choose standard or custom ratios

2. Multiple Loan Types Support

Support for various loan products makes the tool versatile:

-

Conventional Loans – Based on the 28/36 rule (28% housing, 36% total debt)

-

FHA Loans – Allows higher DTI (31% front-end, 43% back-end)

-

VA Loans – For veterans and service members (up to 41% DTI)

-

Custom DTI Ratios – User-defined (between 10% and 50%) for unique situations

3. Detailed Results Display

Get a complete breakdown of affordability analysis:

-

Maximum Borrowing Amount – Based on income, debts, and chosen DTI

-

Total Affordable House Price – Including loan + down payment

-

Required Down Payment – Specified or calculated amount

-

Estimated Closing Costs – Typically around 3% of purchase price

-

Front-End and Back-End DTI Ratios – With visual comparison to standards

-

Total One-Time Payment at Closing – Including down payment, closing fees

-

Monthly Mortgage Payment Breakdown – Principal, interest, taxes, insurance

-

Annual Property Costs – Taxes, insurance, HOA fees

-

Total Monthly Housing Costs – Comprehensive monthly ownership expense

4. Advanced Calculations

The calculator performs complex financial computations for precise results:

-

Front-End DTI – % of income spent on housing costs only

-

Back-End DTI – % of income covering all monthly debt obligations

-

Closing Cost Estimates – Usually 3% of purchase price

-

Maintenance Costs – Estimated at 1.5% of home value per year

-

Property Tax Calculations – Based on local rates or flat amounts

-

Insurance Cost Estimates – Varies by region and coverage

5. Visual Elements

User experience is enhanced with a modern, intuitive interface:

-

Professional Real Estate UI – Clean and responsive

-

Color-Coded Sections – Highlights different cost components

-

Interactive Forms – With real-time input validation

-

Multiple Themes:

-

Professional Blue

-

Financial Green

-

Business Purple

-

Real Estate Orange

-

Property Teal

-

Dark Gray

-

-

Responsive Design – Optimized for desktop, tablet, and mobile

-

Dark Mode Support – For night-time use and accessibility

How to Use the Calculator

-

Enter your annual pre-tax household income

-

Choose your mortgage term and expected interest rate

-

Input existing monthly debts (loans, credit cards, etc.)

-

Set your down payment – percent or fixed amount

-

Add estimated property taxes (percent or flat value)

-

Include HOA/co-op fees and insurance premiums

-

Select loan type or custom DTI ratio

-

Click “Calculate” to view your personalized affordability report

Benefits of Using the House Affordability Calculator

-

Set a realistic home buying budget

-

Understand mortgage qualification requirements

-

Compare multiple loan scenarios

-

Plan for full cost of homeownership

-

Avoid overextending financially

-

Prepare for closing costs and ongoing expenses

Technical Details

-

Uses standard mortgage calculation formulas

-

Complies with industry DTI benchmarks

-

Incorporates regional tax and insurance assumptions

-

Features real-time validation for all inputs

-

Generates professionally formatted results

Use Cases

This tool is useful in a variety of real estate and financial planning scenarios:

-

First-Time Buyers – Assess what’s affordable before house hunting

-

Upgraders – Evaluate whether a larger or better home is financially feasible

-

Refinancing – Understand impact of changing terms or rates

-

Investors – Estimate affordability for rental or resale opportunities

-

Real Estate Agents – Help clients align with realistic price ranges

-

Financial Planners – Assist clients in long-term housing and budgeting strategies

Loan Types Explained

-

Conventional Loans: Follow the 28/36 rule—28% of gross income toward housing, 36% toward total debt.

-

FHA Loans: Designed for first-time buyers; allows more flexibility with higher DTI limits (31% housing, 43% total debt).

-

VA Loans: For qualified veterans and military members, typically with a DTI cap of 41%.

-

Custom DTI Ratios: For borrowers with special financial circumstances, between 10–50%.

Mathematical Formulas

-

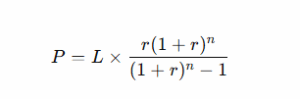

Monthly Mortgage Payment:

Where:

-

PP = Monthly payment

-

LL = Loan amount

-

rr = Monthly interest rate

-

nn = Total number of payments

-

-

Front-End DTI:

-

Back-End DTI:

-

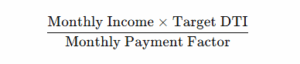

Affordable Home Price:

Financial Planning Tips

-

Improve Your DTI: Pay down debts to free up borrowing capacity.

-

Save for a Down Payment: Larger down payments reduce loan size and interest.

-

Know All Costs: Budget for taxes, insurance, maintenance, and HOA fees.

-

Buy Smart: Don’t rush—wait until finances and the market align.

-

Emergency Funds: Always maintain a buffer for unexpected expenses.

Conclusion

The House Affordability Calculator is an essential tool for anyone planning to buy a home. By considering income, debt, loan types, and all associated costs, this calculator empowers buyers to make well-informed decisions. Whether you’re exploring a first purchase or analyzing an investment, understanding your affordability limits can save you time, money, and stress in the long run.

Start planning your dream home with confidence—use the House Affordability Calculator today.

No Comments