I used to think of my mortgage as this giant, unmovable mountain — 30 years of payments, no way around it. Just this fixed thing I’d be dragging around forever like a ball and chain.

Then one night — sometime around 2 a.m. during one of my insomnia spirals — I found a mortgage payoff calculator. I swear I only clicked it out of curiosity, not because I actually thought it would change anything.

But that tool? It kind of changed everything.

The Wake-Up Call I Didn’t Know I Needed

Let me back up.

I bought my house in 2020, interest rate was decent (4.1%), 30-year fixed, pretty standard stuff. My monthly mortgage payment was around $1,450 — which I had set on auto-pay and promptly tried to forget about.

Fast forward a few years. I was doing okay financially. Not rich, but I had some wiggle room. And I started thinking — what if I just tossed in an extra $100 or $200 a month toward the mortgage?

I figured it might help, but I had no idea how much.

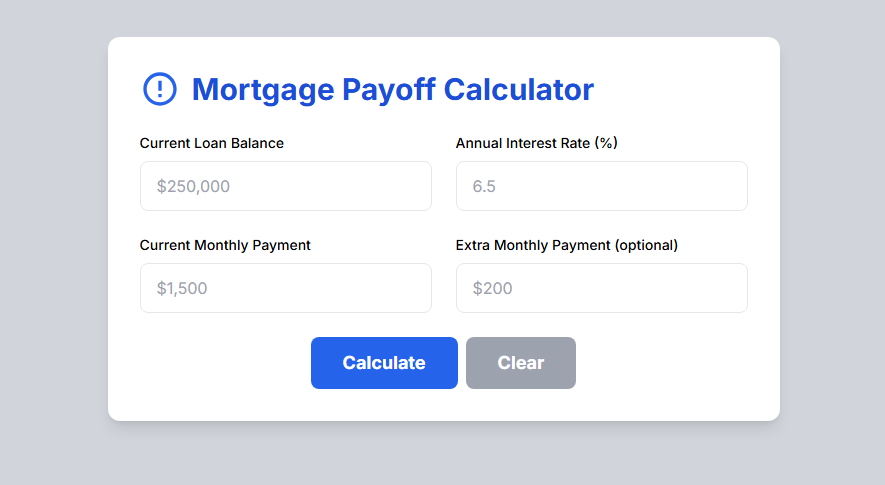

So I typed my numbers into this calculator. Just the basics:

-

Current loan balance: about $245,000

-

Interest rate: 4.1%

-

Current monthly payment: $1,450

-

Extra monthly payment: I tried $200 to start

And the result? I nearly dropped my coffee.

What the Calculator Showed Me

That $200 extra a month — which honestly felt pretty minor — would:

-

Cut 7 years off my loan term

-

Save me over $36,000 in total interest

-

Have me mortgage-free in my early 50s instead of my 60s

I remember just staring at the screen thinking, “Why didn’t I know this sooner?”

Real Talk: The Emotional Part

Look, I’m not a financial planner. I’m just a guy with a house and a mild anxiety problem. The idea of “paying off your mortgage early” always sounded like rich-people talk to me.

But the calculator made it feel real. It wasn’t asking me for a lump sum of $50K or telling me to refinance or sell my soul — just an extra $200 a month. That’s like… skipping takeout and not buying dumb stuff on Amazon for a couple weeks.

And it gave me something I didn’t expect: a sense of control.

The Mistakes I Was Making (Before the Calculator)

-

I thought extra payments only helped a little

-

I didn’t realize how much interest front-loads into those early years

-

I didn’t understand amortization at all — it sounded like dentist equipment

The calculator broke it down for me. Literally year by year, it showed how much principal vs. interest I’d be paying, how my balance would shrink faster, and when I’d be officially “free.”

It even gave me a chart — which, for a visual learner like me, made all the difference.

Why This Tool Is So Damn Helpful

It’s not just the numbers. It’s how easy it is to play with them.

-

Want to try a $50 extra payment? Go for it.

-

Want to see what $500/month would do? Boom — new timeline.

-

Want to switch back and see your original payoff schedule for comparison? Easy.

It makes this massive thing — your mortgage — feel like something you can actually affect. And when you’re drowning in bills, inflation, and adult life in general, that’s a powerful feeling.

What I Actually Ended Up Doing

I didn’t go crazy and throw thousands at my loan overnight. But I did bump up my auto-payment by $250 a month. That was two years ago.

Since then, I’ve already knocked a couple years off my projected payoff. I log into the calculator every few months, adjust some numbers, and keep myself motivated.

Honestly? It’s the most satisfying financial decision I’ve ever made — and it started with a calculator I almost skipped.

Final Thought: You’re Not Stuck with the Timeline the Bank Gave You

If you’re like me — someone who just assumed their mortgage is what it is, forever — please try a mortgage payoff calculator.

Not because it’ll magically make your debt disappear, but because it’ll show you that you have options. You can save thousands. You can be free sooner. You don’t have to be a financial wizard — you just have to care enough to look.

That first $50 extra payment? It matters. The calculator proves it.

No Comments