I’m not gonna lie — the first time someone told me to “run the numbers” on a rental property, I literally opened a blank spreadsheet, stared at it for 30 minutes, and then just closed my laptop and made coffee.

That was two years ago.

Back then, I thought investing in real estate just meant buying a place, renting it out, and watching money roll in. But turns out, it’s not that simple. At all.

Eventually — after messing up one deal and almost buying a second one out of pure FOMO — I found something that helped me chill out and actually think like an investor: a Real Estate Calculator.

Not just a fancy calculator that spits out numbers, but one that made me feel like I finally understood what I was doing.

Why This Calculator Mattered So Much to Me

I’m a visual person. Numbers scare me if I can’t see what they mean.

Before using the calculator, I thought, “Well, the rent covers the mortgage, so I’m good, right?” Nope. That’s how you end up forgetting taxes, maintenance, insurance, and suddenly realizing your “cash-flowing” property is actually losing money.

I didn’t need a real estate degree. I just needed a tool that laid it all out clearly — and let me play with the numbers before I made a $250,000 mistake.

Here’s What I Entered (and What It Taught Me)

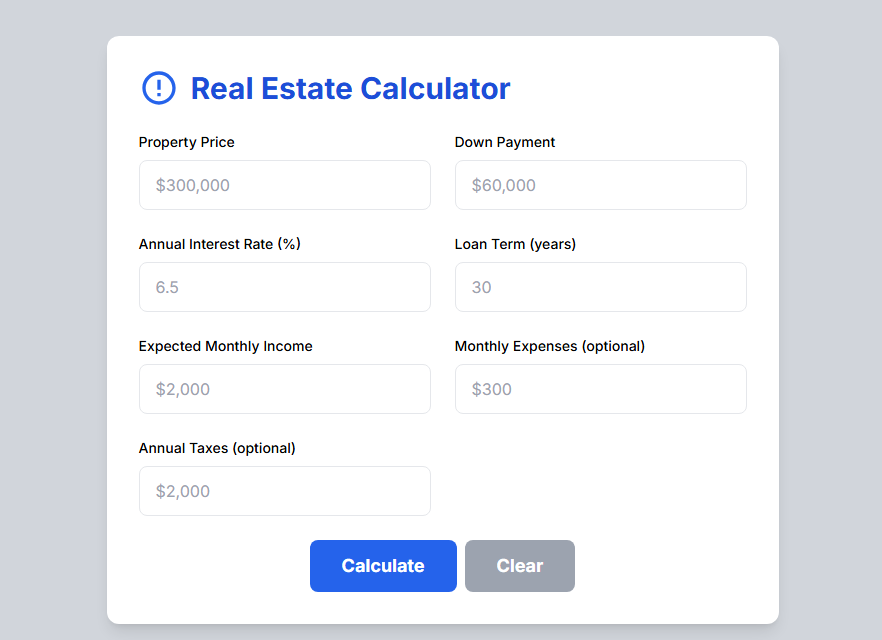

The first time I used it, I plugged in numbers from a property I was obsessing over:

-

Property price: $265,000

-

Down payment: $53,000

-

Interest rate: 6.75%

-

Loan term: 30 years

-

Expected monthly income: $2,000 (from rent)

-

Monthly expenses: around $250 (management, insurance, etc.)

-

Annual taxes: about $2,400

And then… I hit calculate.

Boom. It showed me things I wasn’t even thinking about:

-

My actual monthly cash flow was just a couple hundred bucks.

-

My ROI (return on investment) wasn’t great unless rent increased over time.

-

The loan balance vs. equity over the years made me realize I had to hold this property for at least 7–10 years for it to really make sense.

That one calculation stopped me from jumping into something too fast. And trust me — I wanted to buy. But sometimes, walking away is the smarter play.

The Mistakes I Made (and the Calculator Helped Me Avoid Again)

-

I used to completely forget to factor in property taxes. Like… at all.

-

I’d guess repairs would be “low” because the place “looked clean.” Big mistake.

-

I didn’t realize how much financing costs affect long-term ROI.

The calculator didn’t sugarcoat anything. It just told me: “Here’s the math. You decide.”

That honesty? Weirdly comforting. No hype, no pressure — just facts.

What Makes This Calculator Actually Useful

It wasn’t just the numbers — it was how they were presented.

-

It showed me annual breakdowns — income vs. expenses vs. loan balance.

-

It gave me charts I could understand at a glance (I love visuals).

-

It had tips that popped up next to the results, like “Your cash flow is negative. Try increasing rent or reducing expenses.”

-

It worked on my phone — which was great, because I tend to do this stuff at midnight in bed with 15 tabs open.

And the best part? I could start over easily. Try different down payments. Change the interest rate. Test a worst-case scenario.

It became part of my decision-making process. Not the only thing I used, but definitely the first.

No Comments