I’ll be honest — I never thought I’d sit down and actually calculate whether renting or buying a home made more sense for me. For most of my adult life, I just assumed renting was my thing. No strings, no repairs, no stress.

But last year? Everything changed.

I’d just turned 34. I was living in a one-bedroom apartment in a mid-sized city, paying $1,750 a month. My rent had gone up every year — usually by around $100 — and when my landlord casually mentioned another increase, I snapped. Not outwardly — I’m too polite — but internally, I was like: “Okay, enough is enough. Am I seriously going to rent forever?”

The Panic Spiral (a.k.a. My Google Search History)

Like any modern adult in crisis, I opened ten browser tabs and typed in something like:

“Should I buy a house or keep renting?”

Which led to:

“Rent vs. buy calculator — accurate,”

Which spiraled into:

“Will I regret buying a house alone?”

and

“Is buying a house a scam?”

You get the picture.

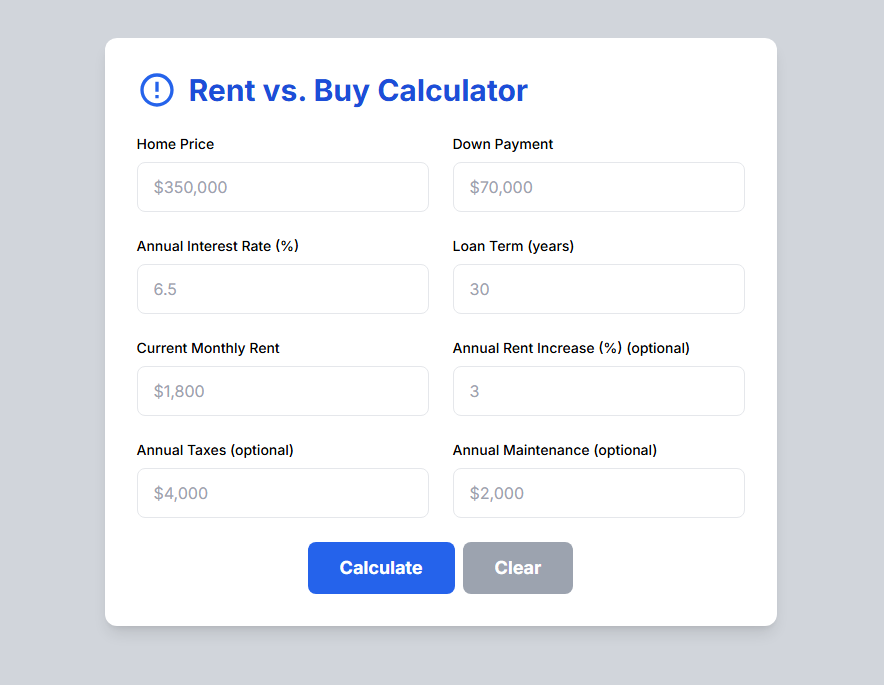

That’s when I landed on a rent vs. buy calculator. I’d seen them before but never really used one properly. This time, I forced myself to sit down and do it right.

What I Entered — and What I Realized

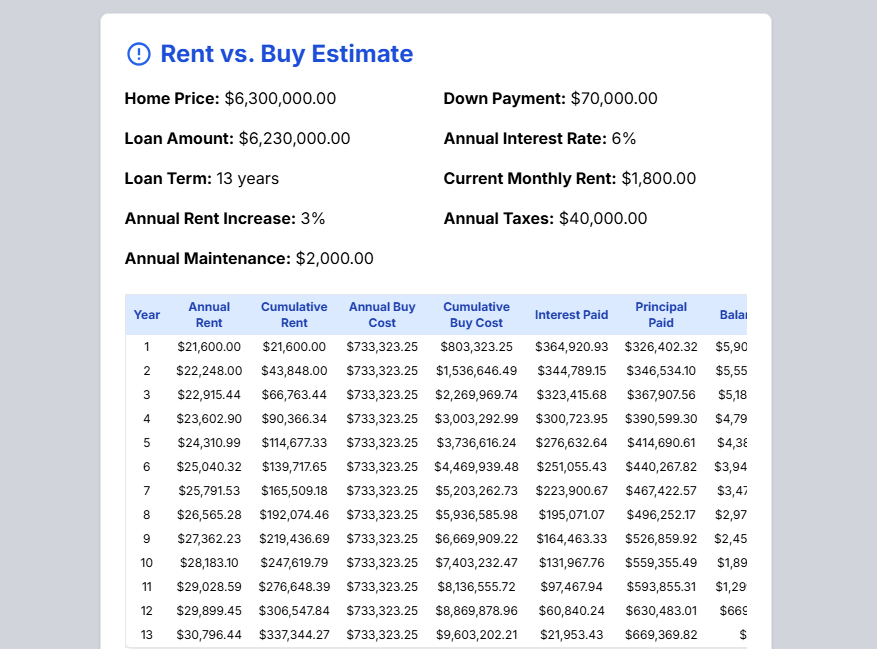

Here’s what I typed into the calculator:

-

Home price: $290,000

-

Down payment: $58,000 (I had some savings, plus help from my parents — which I hated needing)

-

Interest rate: 6.25%

-

Loan term: 30 years

-

Monthly rent: $1,750

-

Annual rent increase: 3%

-

Property taxes: around $3,500/year

-

Maintenance: maybe $1,800/year? I guessed.

It felt weird to even see these numbers side by side. Like, it put all my vague assumptions into actual math.

And the calculator told me — straight up — that if I stayed in the home for more than 6 years, buying would start saving me money. Not immediately. Not even in the first few years. But eventually, the scales tipped.

The Emotional Side (a.k.a. What the Calculator Doesn’t Tell You)

Look, the calculator is amazing for numbers. But it doesn’t account for fear. Or second-guessing. Or how overwhelming it feels to commit to a mortgage when your parents still ask if you’re “sure you’re ready.”

It doesn’t tell you how it feels to see that first “closing cost” estimate and want to throw up.

It doesn’t prepare you for the hours you’ll spend looking at houses that smell like mold and disappointment.

But it did give me a foundation. Something to come back to when I was lost in Zillow or drowning in unsolicited advice from coworkers who bought in the ‘90s for half the price.

Mistakes? Oh, I Made a Few.

-

I underestimated maintenance costs.

-

I forgot to budget for furniture (why is a couch $2,000 now?).

-

I almost signed with a lender just because they “seemed nice.”

But the calculator kept me grounded. Every time I doubted the process, I went back to it. Changed a few numbers. Ran new scenarios. Tried “what if I sell in 5 years?” or “what if interest rates drop?”

It became like a weird little therapist: cold, honest, and always there.

So… What Did I Do?

After months of going back and forth — I bought.

Not the house I thought I wanted. Not in the trendy part of town. But a solid, quiet, 2-bedroom home with a weird kitchen and great sunlight. My mortgage? About $1,570/month.

Yeah, I have to mow the lawn now.

Yeah, the water heater died in month three (ouch).

But I don’t dread the lease renewal email anymore.

And I know — deep in my bones — that I made the right call for me.

Final Thought: It’s Not About the Calculator… But It Helps

The Rent vs. Buy Calculator didn’t make the decision for me.

But it gave me the clarity I needed to even consider it seriously.

It showed me that I wasn’t crazy for wondering if renting forever wasn’t ideal.

It helped me realize that homeownership wasn’t some far-off fantasy.

It helped me ask better questions — and make a decision with my eyes open, not just my emotions.

If you’re stuck like I was, spiraling between rent increases and housing market dread — try the calculator. Not because it has all the answers. But because it’ll give you the questions you actually need to ask.

And honestly? That’s where the real decision starts.

1 Comment